|

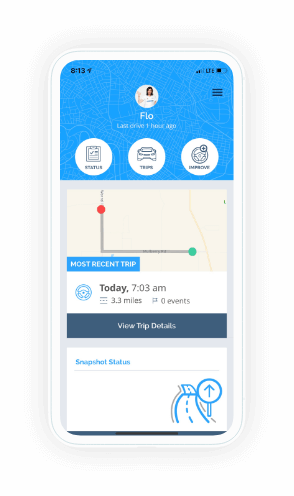

In terms of how insurance firms evaluate risk, provide customized plans, and improve overall road safety, telematics in auto insurance is a revolutionary step forward. This state-of-the-art technology collects data on driving habits in real time via an app on a smartphone or through a gadget connected to an automobile's onboard diagnostics port. The typical data gathered includes vehicle speed, acceleration, braking habits, and operating time of day and night.

One of the primary advantages of telematics is its ability to provide insurers with accurate and individualized insights into a policyholder's driving habits. This data-driven approach enables insurance companies to offer personalized insurance plans tailored to each driver's behavior on the road. Safe drivers, as indicated by the collected data, can receive substantial discounts on their premiums, promoting responsible driving habits. Additionally, telematics devices play a major role in improving road safety. Insurance companies can detect dangerous driving habits like speeding or hard braking by keeping an eye on driving patterns. After that, they might advise policyholders to adopt safer practices by offering comments. Furthermore, this technology facilitates the prompt identification of mishaps. Telematics devices can automatically alert emergency services in the event of a collision, which might speed up response times and save lives. From a customer perspective, telematics-based insurance policies empower individuals to take control of their insurance costs. Drivers can actively monitor their behavior through associated mobile apps or online portals, fostering a sense of responsibility and encouraging them to become safer drivers. Safer drivers are often rewarded with premium discounts that range from 5-40% depending on the insurance company’s program. Furthermore, telematics is good for the environment. Fuel consumption and greenhouse gas emissions are decreased by promoting smoother driving habits. This is in line with international initiatives to build a more sustainable future. To sum up, telematics in vehicle insurance not only revolutionizes the market by enabling more customized and affordable plans, but it also makes a substantial contribution to the promotion of safer driving habits, enhanced emergency response, and the development of a greener environment. The integration of telematics is anticipated to become even more common as technology develops, changing the landscape of auto insurance and traffic safety in the process.

0 Comments

Beginning your teen driver's driving lessons is a significant turning point in their development as an independent and responsible adult. The following are some essential topics to go over and stress in these lessons:

1. Safety First: Stress the value of adhering to speed limits and using seat belts at all times. Describe the risks associated with distracted driving, such as texting or using a smartphone while operating a vehicle. Emphasize the importance of maintaining your attention on the road. 2. Defensive Driving: Instruct your teenager on defensive driving skills, like keeping a safe following distance, seeing blind spots, and anticipating other drivers' moves. Urge them to always be prepared for anything unforeseen when driving. 3. Rules of the Road: Go over the basic traffic laws, such as those pertaining to road signs, signals, and markings. Talk about traffic signal importance and the interpretation of common signs. Make sure they are aware of the right-of-way regulations and when to yield to other vehicles or pedestrians. 4. Vehicle Maintenance: Introduce your teen to basic car maintenance procedures like oil, brake, and tire pressure checks. Describe how routine maintenance keeps cars safe and how skipping it can cause mishaps. 5. Weather Conditions: Talk about the effects of various weather conditions on driving, such as snow, rain, or fog. Instruct them on how to modify their driving technique in inclement weather, such as slowing down and keeping a greater following distance. 6. Handling Emergency Situations: Teach your teenager what to do in the event of an emergency, such as a slipping tire, a failing brake, or a flat tire. Teach them how to stop safely and deal with these kinds of circumstances in a composed and efficient manner. 7. Avoiding Impaired and Drowsy Driving: Stress the risks of operating a vehicle while under the influence of drugs, alcohol, or extreme fatigue. Always make arrangements for a sober ride home if they're going out with friends; encourage them on this. 8. Practice, Practice, Practice: Remind your teen that practice is essential. Offer them plenty of supervised practice hours in various driving conditions and different times of the day. 9. Open Communication: Maintain open communication with your teen about their driving experiences. Encourage them to ask questions and share any concerns they might have. By discussing these points and emphasizing the importance of responsible and safe driving habits, you can help your teen driver become a confident and responsible driver on the road. According to Nevada legislation AB 250, the Birthday Rule establishes a 60-day changeover period that begins on the first day of your birth month. As long as you go by the rules, you will be able to transfer Medigap plans regardless of your health.

You must select a Medigap plan with benefits that are either the same or less than your existing plan in order to benefit from Nevada's birthday rule. For instance, if you presently have Plan F, you can switch to Plan G, which offers fewer benefits, or you can switch to another carrier's Plan F, which has a lower premium (but not the other way around). An outline of the NV Birthday Rule requirements is provided below:

After the first day of your birth month, you have sixty days to change your plans, based on the birthday rule. Remember, you can switch Medigap policies without being subject to the birthday rule but may be subject to underwriting. There are changes to the drug stages for 2024, primarily around the Coverage Gap Stage. To refresh, there are 4 stages of drug coverage during the calendar year and some seniors may fall into that 3rd stage called the Coverage Gap or commonly referred to as The Donut Hole. In 2024, once you and the insurance company have spent $5,030 on your medications, you will enter the Coverage Gap and pay 25% of the retail cost of your medications. This typically drives up costs for Medicare recipients and may cause some confusion for the newer members. The good news is that once you’ve spent $8,000 on your medications, Medicare will pick up the rest of the costs, for the remainder of the calendar year.

The cost of medication for seniors on Medicare, can be overwhelming and expensive. We’ve noticed a few popular prescription drug plans are going to see monthly premium increase in 2024, while some have decided to lower their premium as low as $0. It’s important to review your drug plan options during the Annual Enrollment Period (10/15-12/7) as you may find there is a better plan out there for you. The Insulin Savings Program, which was implemented earlier this year, has helped countless seniors to be able to afford their insulin and the ability to properly manage their diabetes. Many seniors are finding that Eliquis and Xarelto are becoming extremely expensive. If you take these medications, or certain inhalers, you may be eligible for a program that could make these mediations much more affordable. Simply put, you don’t know what you don’t know. Which is why it’s important to work with independent brokers, like Steve & Amy at Blue Sky Insurance. Their goal is to find you a solution to fit your healthcare and financial needs. Consumers must be knowledgeable about home warranties in order to make an informed choice when buying a property in Las Vegas or anyplace else. By covering the price of major home systems and appliances, a home warranty can provide you with peace of mind. Here's what consumers need to know when buying a home warranty in Las Vegas:

1. What Does a Home Warranty Cover? Home warranties often cover large appliances like refrigerators, ovens, and washing machines as well as key systems like HVAC, electrical, and plumbing. However, coverage can vary between different plans and companies. It's crucial to read the contract thoroughly to understand what is included and what is not. 2. Research Reputable Companies The level of service provided by different home warranty companies varies. Investigate and read reviews of various Las Vegas businesses. Choose service providers who have a solid reputation for rapid claim processing and excellent customer service. Consumer review systems and websites like the Better Business Bureau can be useful in this regard. 3. Understand the Costs A service fee (also known as a trade call fee) is charged for each service visit as part of the fees associated with home warranties. Recognize these costs and how they relate to the plan you have selected. Be mindful of any deductibles or uninsured expenses for particular repairs or replacements. 4. Pre-Existing Conditions and Maintenance Requirements Most home warranties do not cover pre-existing conditions, so it's essential to understand the state of your home's systems and appliances before purchasing a warranty. Additionally, some warranties might require proof of maintenance, such as annual HVAC servicing. Failing to meet these requirements might void your warranty. 5. Coverage Limits and Exclusions Home warranties often come with coverage limits, meaning there is a maximum amount the warranty will pay for repairs or replacements. Also, be aware of the exclusions – certain parts or components of the covered systems might not be included in the warranty. Understanding these limits and exclusions is crucial to avoiding unexpected costs. 6. Renewal and Transfer Policies Check the renewal policies of the warranty. Some plans auto-renew, while others require manual renewal. Additionally, if you plan to sell your home, understand the warranty's transfer policy. Some warranties can be transferred to the new homeowner, providing an added benefit during a home sale. 7. Read the Fine Print The terms and conditions of a home warranty are detailed in the contract's fine print. It's tedious to read and understand but beneficial. This includes understanding the process for filing a claim, what documentation is required, and how long it takes for a claim to be processed. 8. Evaluate the Need Consider the age of your home and its appliances and systems. If your home and its components are relatively new, a home warranty might not be necessary as many appliances and systems might still be under the manufacturer's warranty. By being well-informed about these aspects, consumers can make educated decisions when purchasing a home warranty in Las Vegas. It's an investment that can provide significant financial and emotional relief, but only if the terms and conditions align with your specific needs and expectations. Understanding the difference between a home warranty and home insurance can be very beneficial for homeowners.

Home insurance is a comprehensive policy that protects the structure of the house and its contents from various risks such as fire, theft, vandalism, and natural disasters. It not only covers the repair or rebuilding costs but also provides liability coverage if someone is injured on the property. In a city susceptible to unexpected events, home insurance in Las Vegas acts as a financial safety net, ensuring homeowners are protected against significant losses. On the other hand, a home warranty is a service contract that covers the repair or replacement of major home systems and appliances, such as HVAC, plumbing, electrical systems, refrigerators, and washing machines. In a city where air conditioning systems work tirelessly due to extreme heat, having a home warranty can be invaluable. Home warranties are particularly beneficial for older homes or when appliances/systems are no longer under the manufacturer’s warranty. When these essential components malfunction, the home warranty company arranges for repairs or replacements, easing the financial burden on homeowners. Although home insurance protects against unforeseeable disasters and offers liability protection, a home warranty focuses on the maintenance and repair of critical systems and appliances. Both are crucial for Las Vegas residents because they provide thorough protection against a variety of dangers and provide peace of mind in a place where the weather and other elements might provide particular difficulties for homeowners. Amidst the dazzling lights and desert allure of Las Vegas, a curious phenomenon unfolds—the rise in auto insurance rates. It's a tale woven into the fabric of this vibrant city, where each twist and turn reveals a story of its own.

1. The Pulsating Heartbeat of the Strip: The city is filled with sparkling boulevards that are bursting with life. Neon-lit lanes are traveled by locals and tourists, resulting in a dazzling and distracting swirl of headlights and taillights. Because of the increased danger, insurers have raised prices to account for the onslaught of claims due to distraction. 2. Transient Tumult: Las Vegas is a city of transients. Many visitors get into accidents because they are unfamiliar with the city's confusing roads. Due to the ongoing ebb and flow of visitors, this flood of accidents adds a layer of complication that causes insurers to raise rates. 3. Desert Dreams and Harsh Realities: The desert climate is another player in this Las Vegas drama. Summer heat and erratic weather patterns, including flash floods, make driving conditions difficult. The infrequent rain creates slippery conditions as oil and other residues build up over long periods of time. When the rain does come, the roads can be a dangerous place resulting in severe claims. 4. The Phantom Menace of Uninsured Motorists: Because Las Vegas auto insurance rates are high, there are unfortunately many drivers on the road that are driving without insurance. Some estimate that as many as 20% of drivers in Las Vegas are driving around without insurance at any given time. When an accident occurs with an uninsured motorist, the affected driver needs to file a claim through their policy for bodily injury and/or property damage. In order to prepare for the unexpected, insurers charge high premiums for uninsured motorist coverage because they may be compelled to pay for claims that would normally be covered by another insurer. 5. The Underworld of Auto Crime: An underworld of car crime thrives in the dark areas of this lively city. There is a great deal of vehicle theft and vandalism. These risks contribute to the increase in premiums for protection from theft and vandalism. 6. The Legal Ballet: The legal landscape in Nevada is dynamic, and rules and regulations influence the insurance market. Premium adjustments are a result of changing claim costs due to legal changes and evolving trends in personal injury claims. High auto insurance rates in Las Vegas result from a series of interrelated factors in this sparkling metropolis of style and flare. It can be complicated, but we at Blue Sky always try to do our best to help our clients navigate the consistent changes and the complexity of the local insurance marketplace. Feel free to leave us a comment or to give us a call with any of your questions or concerns at 702-410-8020! Navigating the world of Medicare for dental and vision care in Nevada can seem like a complex maze, but with the right guidance, you can chart a course to ensure your oral and visual health needs are met. Here's a step-by-step guide to help you navigate the Medicare landscape for these essential services.

1. Understand Medicare Basics: Learn the fundamentals of Nevada Medicare first. The cornerstone is Original Medicare, which comprises of Parts A (hospital insurance) and B (medical insurance). It's important to remember, though, that routine dental and vision care are NOT INCLUDED in Original Medicare. You are going to have to look toward private insurance companies. 2. Explore Medicare Advantage Plans: Think about signing up for a Medicare Advantage (Part C) plan, which is provided by for-profit insurance providers recognized by Medicare. Dental and eye services are frequently covered under Medicare Advantage plans as additional benefits. 3. Stand-Alone Dental and Vision Plan: Stand-Alone Dental and Vision insurance plans are another viable option. They can be used to complement a Medicare Advantage Plan or serve as your primary coverage if you are not a Medicare Advantage member. You don’t have to enroll in Medicare Advantage to have Dental and Vison Insurance. 4. Check for Network Providers: Dental and vision programs frequently have provider networks. To maximize coverage and reduce out-of-pocket expenses, be sure that the Nevada dentists and eye doctors you choose are included in the plan's network. 5. Assess Premiums and Costs: Know how your chosen plan will affect your finances. Like any insurance dental and vision plans might include deductibles, copayments, coinsurance, and monthly fees or premiums. To measure the overall worth of the plan, compare these expenditures to the coverage offered. 6. Stay Informed About Changes: It's important to review your coverage every year. If there have been any changes to your coverage, including dental and vision benefits, you should review your plan's Annual Notice of Change (ANOC). Be ready to make changes if necessary. For Medicare Advantage members this will need to be done during the Annual Enrollment Period (10/15 – 12/7). 7. Take Advantage of Preventive Services: Preventive care is key to avoiding the high costs associated with major procedures. Make use of coverage for regular eye exams, dental cleanings, and oral exams to identify problems early and lower your chance of developing more serious concerns later. You don't have to figure out Medicare or dental and vision on your own; it might be a complicated system. For help understanding your options and making decisions, get in touch with Medicare.gov or the Nevada State Health Insurance Assistance Program (SHIP). Nevada residents can even call Blue Sky Insurance at 702-410-8020! You may be the boss but you need workers’ compensation insurance as a form of protection for both yourself as the employer and your employees. Workers compensation insurance just might save your business. It offers financial support in the event that one of your employees gets hurt or becomes ill while performing their job-related duties. Without workers' compensation insurance, YOU can be responsible for paying for medical care, lost earnings, and other associated costs, which might have a crippling financial impact on your company.

Workers compensation claims can arise from jobs like construction that require a lot physical exertion but they can also happen in office environments. It's a policy that every company needs regardless of the work they perform. When an employee sustains an injury or falls ill as a result of employment-related activities, workers' compensation insurance pays payments to the employee. These benefits may cover things like medical expenditures, rehab fees, and lost pay incurred while the person was unable to work. The employee agrees to give up their right to sue the employer in return for medical treatment and/or wage replacement. It is crucial to remember that most states have laws requiring workers' compensation insurance, so not having this protection in place can have serious legal and financial repercussions. Working with an experienced insurance expert is crucial to ensuring that you have enough coverage for the specific needs of your company. |

Contact Us(702) 410-8020 Archives

February 2024

Categories |

Navigation |

Connect With UsShare This Page |

Contact UsBlue Sky Insurance Group

7485 West Azure Drive Suite 122 Las Vegas, NV 89130 (702) 410-8020 Click Here to Email Us |

Location |

Website by InsuranceSplash

Hours of Operation

Monday - Thursday 9am-5pm

Friday 9am-4pm

Monday - Thursday 9am-5pm

Friday 9am-4pm

RSS Feed

RSS Feed