|

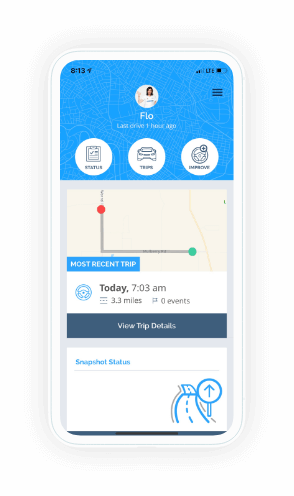

In terms of how insurance firms evaluate risk, provide customized plans, and improve overall road safety, telematics in auto insurance is a revolutionary step forward. This state-of-the-art technology collects data on driving habits in real time via an app on a smartphone or through a gadget connected to an automobile's onboard diagnostics port. The typical data gathered includes vehicle speed, acceleration, braking habits, and operating time of day and night.

One of the primary advantages of telematics is its ability to provide insurers with accurate and individualized insights into a policyholder's driving habits. This data-driven approach enables insurance companies to offer personalized insurance plans tailored to each driver's behavior on the road. Safe drivers, as indicated by the collected data, can receive substantial discounts on their premiums, promoting responsible driving habits. Additionally, telematics devices play a major role in improving road safety. Insurance companies can detect dangerous driving habits like speeding or hard braking by keeping an eye on driving patterns. After that, they might advise policyholders to adopt safer practices by offering comments. Furthermore, this technology facilitates the prompt identification of mishaps. Telematics devices can automatically alert emergency services in the event of a collision, which might speed up response times and save lives. From a customer perspective, telematics-based insurance policies empower individuals to take control of their insurance costs. Drivers can actively monitor their behavior through associated mobile apps or online portals, fostering a sense of responsibility and encouraging them to become safer drivers. Safer drivers are often rewarded with premium discounts that range from 5-40% depending on the insurance company’s program. Furthermore, telematics is good for the environment. Fuel consumption and greenhouse gas emissions are decreased by promoting smoother driving habits. This is in line with international initiatives to build a more sustainable future. To sum up, telematics in vehicle insurance not only revolutionizes the market by enabling more customized and affordable plans, but it also makes a substantial contribution to the promotion of safer driving habits, enhanced emergency response, and the development of a greener environment. The integration of telematics is anticipated to become even more common as technology develops, changing the landscape of auto insurance and traffic safety in the process.

0 Comments

Leave a Reply. |

Contact Us(702) 410-8020 Archives

July 2024

Categories |

Navigation |

Connect With UsShare This Page |

Contact UsBlue Sky Insurance Group

7485 West Azure Drive Suite 122 Las Vegas, NV 89130 (702) 410-8020 Click Here to Email Us |

Location |

Website by InsuranceSplash

Hours of Operation

Monday - Thursday 9am-5pm

Friday 9am-4pm

Monday - Thursday 9am-5pm

Friday 9am-4pm

RSS Feed

RSS Feed