|

Imagine that you just moved into your first apartment with your new roommate. As excited as you are to start making your apartment a home, first things first. Renters Insurance! You find yourself an agent and they get you all setup with coverage for your belongings, so you can rest easy. Your roommate, however, wants to try and save some money and decides not to purchase renters insurance.

One day, your roommate, who is also a smoker, leaves a lit cigarette upstairs and the curtains go up in flames! Thankfully, the fire department was able to put the fire out and no one was hurt. However, as they are throwing your brand-new flat-screen TV and computers out the 2nd story window, you begin to wonder, "how am I going to replace these things and where am I going to stay?" That’s where your renter’s insurance comes in. You can rest easy, once again, because your insurance company hands you a check for a hotel room and to replace your flat-screen TV and computer equipment. Your roommate, on the other hand, is asking if he can stay in the hotel with you because he didn’t choose to purchase renters insurance. To answer the question… YES!

0 Comments

It's important to think about how utilizing your own car for work-related travel can affect your insurance policy in Nevada. Vehicles used for business purposes are usually not covered by personal auto insurance policies, therefore being proactive is necessary to provide proper protection. Considerations include transporting people for a fee. Hauling or transporting goods. Visiting clients or driving clients to meetings.

First, speak with your insurance agent. They can then reach out to your insurance company about your circumstances. Being open and honest about the dual use of your car is essential to preventing coverage lapses. Insurance firms frequently provide commercial auto insurance that is intended especially for automobiles used for business purposes. This kind of coverage can protect you against liability resulting from occurrences related to your business and is more extensive than personal policy. In Nevada, commercial auto insurance frequently includes comprehensive coverage, collision, uninsured/underinsured motorist coverage, bodily injury liability, and property damage liability. Depending on the type of work you do and how much time you spend traveling, different coverage may be required. When estimating your annual mileage for business purposes be precise because this can affect your insurance costs. Your insurance provider can create a policy that is specifically tailored to your needs by receiving comprehensive information on the products and services you carry, as well as the details of your business operations. Additionally, consider obtaining a commercial driver's license (CDL) if your business involves transporting goods or passengers. While not always mandatory for every business use, having a CDL can demonstrate your commitment to safety and professionalism, potentially influencing insurance rates. Make sure your insurance coverage is up to date and meets your changing business demands by reviewing it on a regular basis. Inadequate coverage or concealing commercial use could result in claims being rejected and financial penalties. By being proactive, you can adhere to Nevada's insurance laws while safeguarding your personal and corporate interests. While submitting a homeowners insurance claim can be a difficult process, there are actions you can take to make the process go more smoothly. This is a guide for homeowners who are thinking about filing a claim:

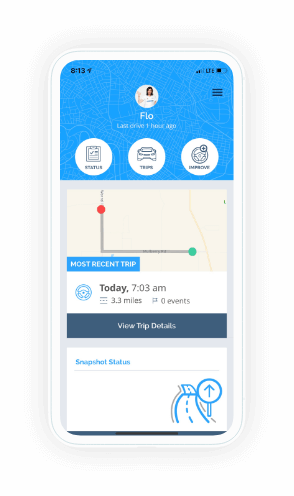

In terms of how insurance firms evaluate risk, provide customized plans, and improve overall road safety, telematics in auto insurance is a revolutionary step forward. This state-of-the-art technology collects data on driving habits in real time via an app on a smartphone or through a gadget connected to an automobile's onboard diagnostics port. The typical data gathered includes vehicle speed, acceleration, braking habits, and operating time of day and night.

One of the primary advantages of telematics is its ability to provide insurers with accurate and individualized insights into a policyholder's driving habits. This data-driven approach enables insurance companies to offer personalized insurance plans tailored to each driver's behavior on the road. Safe drivers, as indicated by the collected data, can receive substantial discounts on their premiums, promoting responsible driving habits. Additionally, telematics devices play a major role in improving road safety. Insurance companies can detect dangerous driving habits like speeding or hard braking by keeping an eye on driving patterns. After that, they might advise policyholders to adopt safer practices by offering comments. Furthermore, this technology facilitates the prompt identification of mishaps. Telematics devices can automatically alert emergency services in the event of a collision, which might speed up response times and save lives. From a customer perspective, telematics-based insurance policies empower individuals to take control of their insurance costs. Drivers can actively monitor their behavior through associated mobile apps or online portals, fostering a sense of responsibility and encouraging them to become safer drivers. Safer drivers are often rewarded with premium discounts that range from 5-40% depending on the insurance company’s program. Furthermore, telematics is good for the environment. Fuel consumption and greenhouse gas emissions are decreased by promoting smoother driving habits. This is in line with international initiatives to build a more sustainable future. To sum up, telematics in vehicle insurance not only revolutionizes the market by enabling more customized and affordable plans, but it also makes a substantial contribution to the promotion of safer driving habits, enhanced emergency response, and the development of a greener environment. The integration of telematics is anticipated to become even more common as technology develops, changing the landscape of auto insurance and traffic safety in the process. |

Contact Us(702) 410-8020 Archives

July 2024

Categories |

Navigation |

Connect With UsShare This Page |

Contact UsBlue Sky Insurance Group

7485 West Azure Drive Suite 122 Las Vegas, NV 89130 (702) 410-8020 Click Here to Email Us |

Location |

Website by InsuranceSplash

Hours of Operation

Monday - Thursday 9am-5pm

Friday 9am-4pm

Monday - Thursday 9am-5pm

Friday 9am-4pm

RSS Feed

RSS Feed